Once again the Federal Reserve's perspective of reality is proven to be warped to the upside. This week they released their most recent findings after the FOMC meeting and they were not pretty. All of their projections were cut and to be honest I believe that they are still way too high. The frustration that I have with them and their projections is that rather than being based on the reality of the state of the global economy they seem to be basing their projections on what they are "hoping" will happen. For you long time followers of this blog you will know by now that as far as a trader is concerned the worst four letter word in the English dictionary is "hope". "Hope" is always a last resort and is normally followed by sh#t, f*%k and the rest of the four letter word vocabulary when the event turns out to be something other than what you were hoping for.

So let's take a look at the most recent changes to the Fed's Economic Projections:

|

2012

|

2013

|

2014

|

|

|

Change

in real GDP

|

1.9 to 2.4

|

2.2 to 2.8

|

3.0 to 3.5

|

|

April

projection

|

2.4 to 2.9

|

2.7 to 3.1

|

3.1 to 3.6

|

|

Unemployment

rate

|

8.0 to 8.2

|

7.5 to 8.0

|

7.0 to 7.7

|

|

April

projection

|

7.8 to 8.0

|

7.3 to 7.7

|

6.7 to 7.4

|

|

PCE

inflation

|

1.2 to 1.7

|

1.5 to 2.0

|

1.5 to 2.0

|

|

April

projection

|

1.9 to 2.0

|

1.6 to 2.0

|

1.7 to 2.0

|

|

Core

PCE inflation

|

1.7 to 2.0

|

1.6 to 2.0

|

1.6 to 2.0

|

|

April

projection

|

1.8 to 2.0

|

1.7 to 2.0

|

1.8 to 2.0

|

Let's start with GDP growth. Two month's ago it was projected to be 2.4% to 2.9%, now it has been revised down to 1.9% to 2.4% a 20 percent reduction! As you all know I believe that this year we will do around 1.5% so I believe that they are still at a minimum 20 percent too bullish even after the reduction. Looking forward somehow they magically believe that regardless of the problems in Europe and the rest of the world that by 2014 we will be humming along at 3.1% growth. Good luck with that projection! I would agree with them if we were spending our money on fixing the economy, but just printing money has not and will not work as they have no control over where it ends up. Had we spent $3 trillion on "shovel ready" projects, by now our roads, bridges and other infrastructure projects would be world class and we would have far lower levels of unemployment and, I would be bullish. But we haven't and still they believe it will work - amazing.

So let's turn to the unemployment rate. As you can see the rate is rising! So much for kick starting the economy. Also how do you propose getting the economy restarted without either help from outside the US in the form of growing exports (this will not happen as weakness abounds around the globe and the dollar is strengthening on the back of Euro weakness) or from lowering unemployment so that there is demand for goods and services from the local population? As our government does not have any shovel ready projects and as the horse has left the building without taking the cart with it (we printed the money and did not use it to create jobs) it seems that we will stagnate for the foreseeable future. Also you can clearly see that unless GDP growth exceeds 4% little will happen in the way of reducing the unemployment level as the number of new entrants into the workforce will more than offset any job growth at levels less than 4 percent.

The good news is that inflation is coming down, however it is looking more and more likely that we will end up in a deflationary spiral much like Japan and this will lead to low interest rates for a very long time. The bad news is that without inflation the debt burden remains stubbornly high in relationship to the asset levels and this will result in further expenditure on lowering debt levels at the consumer level resulting in even more debt at the government level (the only way to reduce both levels is to have a large budget surplus and a high savings rate and we have neither!). Higher government debt will lead to enormous problems later and will continue to crowd out the private sector slowing growth further.

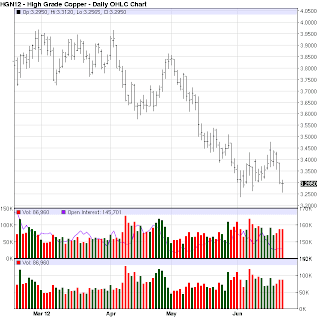

Looking at global trade for signs that the global economy is beginning to turn for the better prints a very bleak picture. My two favorite barometers of global trade are copper prices and the bulk shipping rate index. As you can see from the charts below, neither of them are showing any global strength.

So why anyone thinks it is a good time to invest in the stock market right now is beyond me. There is no magic wand to wave so be prepared for numerous downside shocks to the market and low interest rates for a long time to come. Hunker down and explore alternatives to the stock market.

No comments:

Post a Comment